An Eloquent Solution

- Dec 9, 2017

- 3 min read

Fear not if you don’t have a PhD in Applied Mathematics. It won’t help you solve this complex conundrum, a Daedalian dichotomy, thwarting the best of us. Are you better off with Stepped or Level premiums when choosing the most cost-effective way to pay for your personal insurance? But is the solution to this problem an either-or approach?

Stepped premiums are start off lower initially (40% on average, depending on your age at commencement) and increase annually based on your actuarial risk. Level premiums increase more modestly over time, potentially saving you many thousands of dollars. The latter however effectively require long term commitment to the same insurer and product, potentially foregoing any future product improvements.

“This non-core cover should be increased and reduced as your changing needs and circumstances mandate. If all goes to plan, you won’t need this cover at age 65…”

If we commence at age 45 and project Stepped and Level premiums to age 65, we observe significant cost savings in favour of Level premiums over this period. The amount depends on the amount and type of cover you compare.

Most people will need the greatest amount of personal insurance (Life, TPD, Trauma, Income Protection and maybe Business Expenses) between ages 35 and 50 due to commitments such as debt and children, and fewer assets. At age 60 the picture is often very different, with independent or semi-dependent children and a significantly stronger balance sheet. A second marriage or staring a family later in life can extend this period of peak financial risk and ‘insurance dependency’.

A good insurance adviser will know when you no longer need as much insurance and help you prudently reduce your cover levels. They will also consider your potential needs over the next 20 years and how these may change over time.

I refer to Core cover needs - those insurances that you are likely to benefit from retaining for the longer term. If they represent a sound cost-benefit trade-off, it is prudent to retain some level of Income Protection and Trauma (and potentially Life and TPD cover, depending on your circumstances). Level premiums are ideal for this Core cover, allowing you to maintain this for a longer period of time. Stepped premiums escalate quite sharply in your late 50’s.

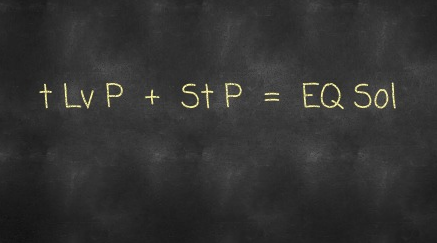

“The question is therefore not ‘Stepped or Level’ but rather, ‘How much

of each, and when’. Combining both Stepped and Level premiums can potentially achieve the right balance between your current and anticipated future needs and cost of these decisions.”

In addition to this Core of cover, you may have additional or Non-Core cover. This non-core cover should be increased and reduced as your changing needs and circumstances mandate. If all goes to plan, you won’t need this cover at age 65, potentially having started scaling it back from age 55. For example, with two young children and all the associated financial commitments you may need to maximise your Income Protection benefit payable in the event of illness or disability. Beyond age 60 a more cost-effective solution may be to protect 50% or less of your income and extend the waiting period to help reduce cost. You are effectively self-insuring when you are more financially able to do so.

The question is therefore not ‘Stepped or Level’ but rather, ‘how much of each, and when’. Combining both Stepped and Level premiums can potentially achieve the right balance between your current and anticipated future needs and cost of these decisions.

The solution of course needs to take into account a number of variables and make medium and long-term assumptions about these. It should also be noted that not all Level premiums are equal. Many insurers add insidious annual premium increases with inflation-linked benefit increases. There are a small group of insurers who do not do this; they offer what’s called ‘True Level’ premiums. A good adviser will be thinking about these issues and discussing them with you at regular reviews.

General Advice Disclaimer:

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances.

![endif]--![endif]--

Comments